The Debt Avalanche Payoff Method

Here, we will discuss the Debt Avalanche Payoff Method to help pay off your credit card debt, or other debt you may be dealing with.

The debt avalanche method is a debt repayment strategy designed to save you the most money in interest and help you get out of debt faster.

Here is how It works:

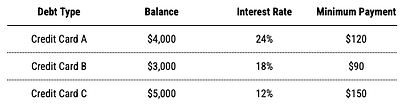

1.) List all of your debts, including the balances, monthly payments, and interest rates.

2.) Make minimum payments on all of your debts

3.) Put any extra money toward the debt with the highest interest rate first (this is your "avalanche target"

4.) Once that debt is paid off, roll the freed-up amount into the next highest interest debt.

5.) Repeat until all debts are paid off.

Example:

- You make all minimum payments towards your credit card balances.

- Any extra money you have will go towards Credit Card A, since that has the highest interest rate.

- After Credit Card A is paid off, you will focus on Credit Card B until that is paid off, and then Credit Card C until that is paid off.