The Debt Snowball Payoff Method

Here, we will discuss the Debt Snowball Method and how it works for clients to tackle their credit card debt, or other debt they have.

The debt snowball method is a debt repayment strategy that focuses on paying off your smallest debts first, regardless of the interest rate, while making minimum payments on the rest of the debts. The main idea of this strategy is to build momentum and motivation as you eliminate individual debts.

How the Debt Snowball Method Works:

1.) List your debts from smallest to largest balance (not interest rate)

2.) Make minimum payments on all debts except the smallest.

3.) Put all extra money toward the smallest debt until it's paid off.

4.) Once that debt is gone, roll its payment into the next smallest debt you have.

5.) Repeat the process until you're debt free.

Example:

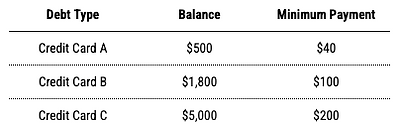

- First, you would start with Credit Card A, since that has the smallest balance.

- Pay extra toward it each month (ex. $100 total)

- Once it's paid off, apply that $100 to Credit Card B, now paying $200 a month total towards that card.

- When Credit Card B is done, apply the $200 (Card B) + $200 (Card C minimum payment), now paying $400 in total toward Credit Card C.